Calculate land value for depreciation

It means any asset that can be touched and felt could be labeled a tangible one with a long-term valuation. If we apply the equation.

Example Of A Property With A Good Cash Flow Return Green Label Positive Cash Flow Cash Flow Statement Cash Flow

The Replacement cost can be estimated using the replacement method which estimates the cost of constructing a building with the same level of utility as the one being valued.

. For the next year you would start the depreciation calculation from the original cost minus the depreciation cost. Now that you know the basis of the property house plus land and the value of the house you can determine your basis in the house. Having the right amount of home insurance is vital to ensure youre covered in a claim.

To calculate depreciation we must first identify the acquisition cost salvage value and useful life. Calculate the depreciation percentage based on sinking fund method for a building at the age 16 years having life of 50 years at. Book value Cost of the Asset Accumulated Depreciation.

In case they cannot calculate its value they cannot capitalize it either. NADA does not factor in any accessories into the Retail Price. The 200 percent depreciation rate is calculated the same way as the straight-line method except that the rate is 200 percent of the straight-line rate.

Add the market value of the land with this price to get. The amount deducted from the value of any tangible asset Tangible Asset Tangible assets are assets with significant value and are available in physical form. Next determine the depreciation rate category based on the propertys natureIt would be either 5 10 or 100 which would be used to calculate the annual depreciation of the building.

GDS using 150 declining balance. If a company purchases a computer worth 1000 with a projected lifetime of 4 years and you want to depreciate it at a 20 reducing balance you would simply multiply 1000 by 20 which gives you a value of 200. The items found in the data table are the same.

The cumulative total in the last year will equal the Depreciable Asset Value minus the Salvage Value. For our playground structure lets say the cost was 21500. NADA Retail Value is an arbitrary number that is based off what NADA calculated as the price an RV would have sold for when new.

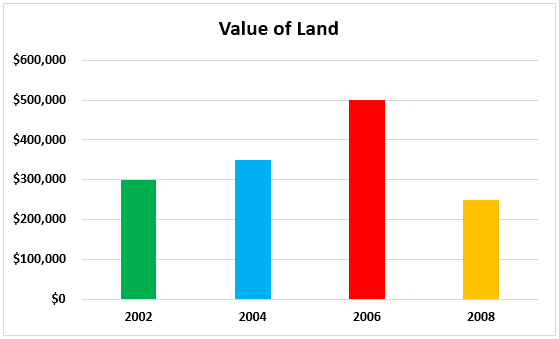

This chart is essentially an inverse chart of the Cumulative Depreciation chart. The cost of filling of the tank 200 x 3 x 10 Rs. Property Value Replacement Cost Depreciation Land Value.

20 Machinery and Equipment. Read more in cash flow or a. Market value includes the value of the land which isnt covered by insurance.

Replacement cost only covers the cost to rebuild the house itself. 100- per sqm. A rate of interest of 6 may be adopted to work out the present value of the land.

Using the above example. After determining the cost companies need to estimate the useful life of the improvement. 6000- The price of adjoining solid land 10 years hence Rs.

As for the residence itself the IRS requires you to calculate depreciation over its 275 useful years using a different method called the modified accelerated cost recovery system. Companies need to start by establishing the cost of improvements. How to Calculate Depreciation Recapture on Rental Property.

06232021 06162019 by Ben Mizes. Take a look at the above 397TH NADA report the MSRP is the same at the top and bottom. Since its used to reduce the value of the asset accumulated depreciation is a credit.

The 200 or double-declining depreciation simply means that the depreciation rate is double the straight-line depreciation rate used for later property classes. Depreciable Asset Value - The depreciable asset value left in a given year during the life of the asset. For instance if a buyer is selling a property after 10 years of construction the selling price of the structure can be calculated through following formula-.

Calculating Depreciation Using the 200 Percent Method. The formula used to calculate the value of a commercial property using the cost approach is. To calculate the depreciation of building component take out the ratio of years of construction and total age of the building.

Final Thoughts on Land Depreciation. Well use a salvage value of 0 and based on the chart above a useful life of 20 years. Calculate the 200 percent rate in the same way as the 150 percent method except substitute 20 200 percent instead of 15.

The depreciation rate can also be calculated as the reciprocal of the useful life Useful Life Useful life is the estimated time period for which the asset is expected to be functional and can be. NADA uses the Retail Price to set the depreciation schedule. How to Calculate Depreciation.

After having all the values in hand we can apply the values in the below formula to get the depreciation amount. Its building value because land cant be depreciated The investor takes 30000 depreciation each year for ten years. That means the propertys adjusted cost basis is 200000 the.

Like any other depreciable asset the accounting treatment for land improvements depreciation is straightforward. Accumulated depreciation is known as a contra account because it has a balance that is opposite of the normal balance for that account classification. Total amount of depreciation taken.

Total Depreciation Expense 2 Straight Line Depreciation Percentage Book Value Relevance and Uses of Depreciation Expenses Formula. Depreciation is an important calculation in accounts. This depreciation method gives you a higher depreciation rate 150 more than the straight-line method.

Remember when shopping around with different. The purchase price minus accumulated depreciation is your book value of the asset. Home replacement cost isnt the same as a homes market value.

Depreciation Methods Principlesofaccounting Com

Salvage Value Formula And Example Calculation Excel Template

Depreciation Rate Formula Examples How To Calculate

Financial Calendar 2019 2020 Week Number 25 Free Calendar Template Period Calendar Calendar Printables

Depletion Method Of Depreciation Accounting Education Economics Lessons Finance Class

Depreciation Change In Useful Life Youtube

How To Calculate Land Value For Taxes And Depreciation Accounting Marketing Calendar Template Financial Wellness

Depreciation Formula Calculate Depreciation Expense

Salvage Value Formula Calculator Excel Template

How To Calculate Depreciation Youtube

Does Land Depreciate In Value Accounting Effect Examples

Definition Of Net Present Value Financial Calculators Financial Education Financial Problems

How To Use Rental Property Depreciation To Your Advantage

How To Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

Salvage Value Formula Calculator Excel Template

Depreciation Formula Calculate Depreciation Expense